- CFA Exams

- 2026 Level I

- Topic 6. Fixed Income

- Learning Module 7. Yield and Yield Spread Measures for Fixed-Rate Bonds

- Subject 1. Periodicity and Annualized Yields

Seeing is believing!

Before you order, simply sign up for a free user account and in seconds you'll be experiencing the best in CFA exam preparation.

Subject 1. Periodicity and Annualized Yields PDF Download

Fixed-rate bonds are those that pay the same amount of interest throughout their specified term. Measurement for fixed-rate bonds depends on the timing of the bond's cash flows.

Yield measures are used to evaluate the rate of return on bonds.

- They are typically annualized.

- Money market rates are simple interest rates. They are annualized but NOT compounded.

- Non-money market rates are compounded.

Yields-to-maturity allow analysts to use a single measure to compare bonds with varying maturities and coupons.

The periodicity of an annual interest rate is the number of periods in the year.

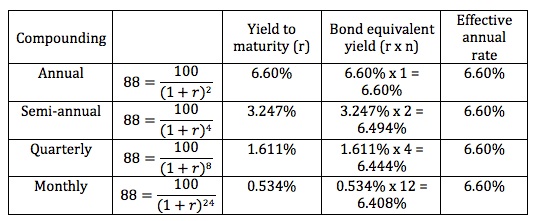

Consider a two-year, zero-coupon bond priced now at 88 per 100 of par value.

Note:

- The effective annual rate is the same.

- The bond equivalent yield and the periodicity are inversely related.

- When comparing different bonds, it is essential to compare the yields for the same periodicity to make a statement about relative value.

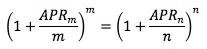

To convert an annual yield from one periodicity to another:

Example

- A Eurobond pays coupons annually. It has an annual-pay YTM of 8%.

- A U.S. corporate bond pays coupons semi-annually. It has a bond equivalent YTM of 7.8%.

- Which bond is more attractive, if all else equal?

Solution 1

- Convert the U.S. corporate bond's bond equivalent yield to an annual-pay yield.

- Annual-pay yield = [1 + 0.078/2]2 - 1 = 7.95% < 8%

- Therefore, the Eurobond is more attractive since it offers a higher annual-pay yield.

Solution 2

- Convert the Eurobond's annual-pay yield to a bond equivalent yield (BEY).

- BEY = 2 x [(1 + 0.08)0.5 - 1] = 7.85% > 7.8%

- Therefore, the Eurobond is more attractive since it offers a higher bond equivalent yield.

User Contributed Comments 12

| User | Comment |

|---|---|

| CHADZAMIRA | This is reasonably straight forward but be careful with the conversion process. |

| ramtor | use the iconv function of BAII plus |

| JimM | Using the ICONV function of BAII plus (it's on the "2" key), remember to set C/Y = 2, not 365. NOM = BEY EFF = Annual-pay yield Set 1 of those, CPT the other. |

| jpducros | Remember that you'll always have : MMY<BEY<EAY MMY : Money Market Yield : no compounding - 360 d/year BEY : Bond Equiv. Yield : Semi-Annual Compounding - 365 d/y EAY : Effective annual Yield : compounding for the entire year, based on 365 d/y |

| anaraguin | Thank you so so much JimM! :) |

| moneyguy | That still doesn't tell me how to actually apply the iconv button to calculate this stuff, JimM |

| 2014 | thanks jim |

| tichas | Chadzamira , iwe |

| SAB1987 | Thank you JimM |

| davidbenke | @moneyguy US corporate bond example: [2nd][2] NOM = [7][.][8] C/Y = [2] EFF = [CPT] EFF should equal 7.952 |

| philerup | TIL how to use ICONV. Thanks Jim! |

| phill | why do them all have the same EAR and how is that calculated? |

You have a wonderful website and definitely should take some credit for your members' outstanding grades.

Colin Sampaleanu

My Own Flashcard

No flashcard found. Add a private flashcard for the subject.

Add