Seeing is believing!

Before you order, simply sign up for a free user account and in seconds you'll be experiencing the best in CFA exam preparation.

Subject 1. Mean-variance analysis

So what is mean-variance analysis? Investors can use mean return and variance of return to measure the value of any investment opportunities.

Mean-variance analysis is based on several very important assumptions.

- All investors are risk averse. Investors differ in the level of risk they want to take. However, for a given risk level, investors always prefer higher returns to lower returns, or for a given return level, investors always prefer less risk to more risk.

- Expected returns for all assets, the variances and covariances of all asset returns are known.

- Investors base all their decisions on expected returns, variances and covariances.

- There are no taxes or transaction costs involved in buying or selling assets.

Under these assumptions a portfolio is considered to be efficient if no other portfolio offers a higher expected return with the same or lower risk, or lower risk with the same or higher expected return.

Portfolio Expected Return and Variance

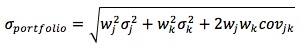

The expected return on a portfolio of assets is the market-weighted average of the expected returns on the individual assets in the portfolio. The variance of a portfolio's return consists of two components: the weighted average of the variance for individual assets, and the weighted covariance between pairs of individual assets.

Example

You have a portfolio of two mutual funds, A and B, 75% invested in A.

E(RA) = 20%; E(RB) = 12%.

Covariance Matrix:

The values on the main diagonal are the variances, and the other values are the covariances.

The expected return on the portfolio is:

E(Rp) = wAE(RA) + (1 - wAE(RB)) = 0.75 x 20% + 0.25 x 12% = 18%.

The correlation matrix:

σ(RA) = (625)1/2 = 25, σ RB) = (196)1/2 = 14.

ρ(RA, RB) = Cov(RA, RB) / (σ(RA) x σ(RB) = 120 / (25 x 14) = 0.342857, or 0.34.

The variance of the portfolio is:

σ2(RP) = wA2σ2(RA) + wB2σ2(RB) + 2wAwBCov(RA, RB)

= (0.75)2(625) + (0.25)2(196) + 2(0.75)(0.25)(120) = 408.8125

The standard deviation is: σ(RP) = (408.8125)1/2 = 20.22%.

It's also possible that you could be given a correlation matrix, which is simply a matrix that shows the correlation between any two assets in the portfolio. Consider the following correlation matrix for assets A, B and C.

Note that the matrix is symmetrical about its main diagonal (top left to bottom right). The entries on this diagonal are all 1, as the correlation between any variable and itself is obviously 1. Similarly, the correlation between RA and RB is 0.53, the correlation between RA and RC is 0.78 and the correlation between RB and RC is 0.6.

The steps that would now be involved would be:

- Calculate expected values and variances for the return on each asset.

- Square-root your variances in each case to get standard deviations.

- Use the standard deviations together with the correlations from the matrix above to calculate covariances using the link formula.

- Calculate the values of the portfolio weights.

- Now calculate E(Rp) and Var(Rp) using the above formulae.

Essentially, the processes are the same. In each case, we need to obtain expected values, variances and covariances, because we need them in order to calculate E(Rp) and Var(Rp). How we obtain them depends on how the data are presented to us.

Familiarize yourself with the two different types of matrices as explained in this section, and know what each term represents in each covariance formula.

Practice Question 1

Which statement is true regarding mean-variance portfolio theory?

A. It assumes that all investors have the same tolerance for risk.

B. To determine optimal portfolios investors need only to know returns, variances, covariances, skewness and kurtosis of returns.

C. The value of investment opportunities can be meaningfully measured in terms of return and variance of return.

D. It assumes investors know the past value of mean, variances and covariances of returns. However, the future values of these parameters are unknown.

A: All investors are risk averse. B: Investors need only to know returns, variances and covariances. D: It assumes the future values of these parameters are also known.

Practice Question 2

Assume a portfolio with 25% stocks (S) and 75% bonds (B). The expected return from stocks is 7.9% and the expected return from bonds is 4.5%. The incomplete covariance matrix for the returns of this portfolio is as follows:

We know that p(S,B) = -0.125. What is the variance of return on this portfolio?

A. 16.19

B. 18.06

C. There is not enough information to make the computation.

First compute the variance for bonds:

p(S,B) = -5 / [641/2 x Var(B)1/2] = -0.125 ==> Var(B) = 25.

Then proceed to calculate the variance of return on the portfolio:

V(RP) = V(0.25 x RS + 0.75 x RB) = 0.252V(RS) + 0.752V(RB) + 2 x 0.25 x 0.75 x Cov(RS, RB) = 16.1875.

Practice Question 3

Assume a portfolio with 25% stocks (S) and 75% bonds (B). The expected return from stocks is 7.9% and the expected return from bonds is 4.5%. What is the expected return of this portfolio?

A. 3.38%

B. 5.35%

C. 6.32%

The expected return for this portfolio is: E(R) = 0.25 x 7.9 + 0.75 x 4.5 = 5.35%.

Practice Question 4

Assume a portfolio with 35% stocks (S) and 35% bonds (B) and 30% in a mutual fund (F). The expected return from stocks is 12%, the expected return on the mutual fund is 7% and the expected return from bonds is 5%. What is the expected return on this portfolio?

A. 8.00%

B. 8.05%

C. 8.15%.

The expected return for the portfolio is calculated as follows: E(R) = 0.35 x 12 + 0.35 x 5 + 0.3 x 7 = 8.05%.

Practice Question 5

Assume that we have 3 assets in a portfolio, the respective market values of which are $100, $400 and $500. Suppose also that E(R1) = 2%, E(R2) = 4% and E(R3) = 6%. The whole portfolio has a market value of $1000. Determine the expected return of the portfolio.A. $2.

B. $16.

C. $48.Correct Answer: C

Since the whole portfolio has a market value of $1000, the respective weights would be:

W1 = 100 / 1000 = 0.1.

W2 = 400 / 1000 = 0.4.

W3 = 500 / 1000 = 0.5.

So, E(Rp) = 0.1 x 1000 x 2% + 0.4 x 1000 x 4% + 0.5 x 1000 x 6% = $48.

Study notes from a previous year's CFA exam:

1. Mean-variance analysis