Seeing is believing!

Before you order, simply sign up for a free user account and in seconds you'll be experiencing the best in CFA exam preparation.

Basic Question 2 of 2

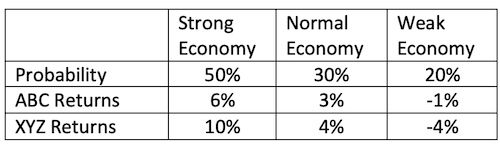

The following table represents the estimated returns for two motor vehicle production brands - ABC and XYZ, in 3 industrial environments: Strong (50% probability), average (30% probability) and weak (20% probability).

Given the above joint probability function, the covariance between ABC and XYZ returns is closest to:

User Contributed Comments 0

You need to log in first to add your comment.

I am using your study notes and I know of at least 5 other friends of mine who used it and passed the exam last Dec. Keep up your great work!

Barnes

Learning Outcome Statements

calculate and interpret the covariance and correlation of portfolio returns using a joint probability function for returns

CFA® 2025 Level I Curriculum, Volume 1, Module 5.